Why financial websites struggle to convert

Complex funnels, generic offers, and hidden signals keep conversions low.

Visitors see generic offers instead of tailored recommendations

Banks and insurers serve the same product list to every visitor. When offers don’t reflect someone’s profile or needs, people disengage — and the chance to connect is lost.

Complex product pages and forms cause high drop-off

Financial products are complicated, with dense product pages and long forms. Without guidance, visitors abandon the process halfway — and your conversion rates take the hit.

Sales teams miss digital intent signals and can’t act in time

High-intent behaviors — like returning to compare options or checking pricing — go unseen. Without these signals, sales doesn’t know who’s ready to buy or when to reach out.

Meet Prepr

The headless CMS that turns financial websites into growth engines

Prepr helps banks and insurers adapt content to each visitor, capture intent signals like repeat visits, and feed them into your CRM — so you convert more visitors into qualified leads.

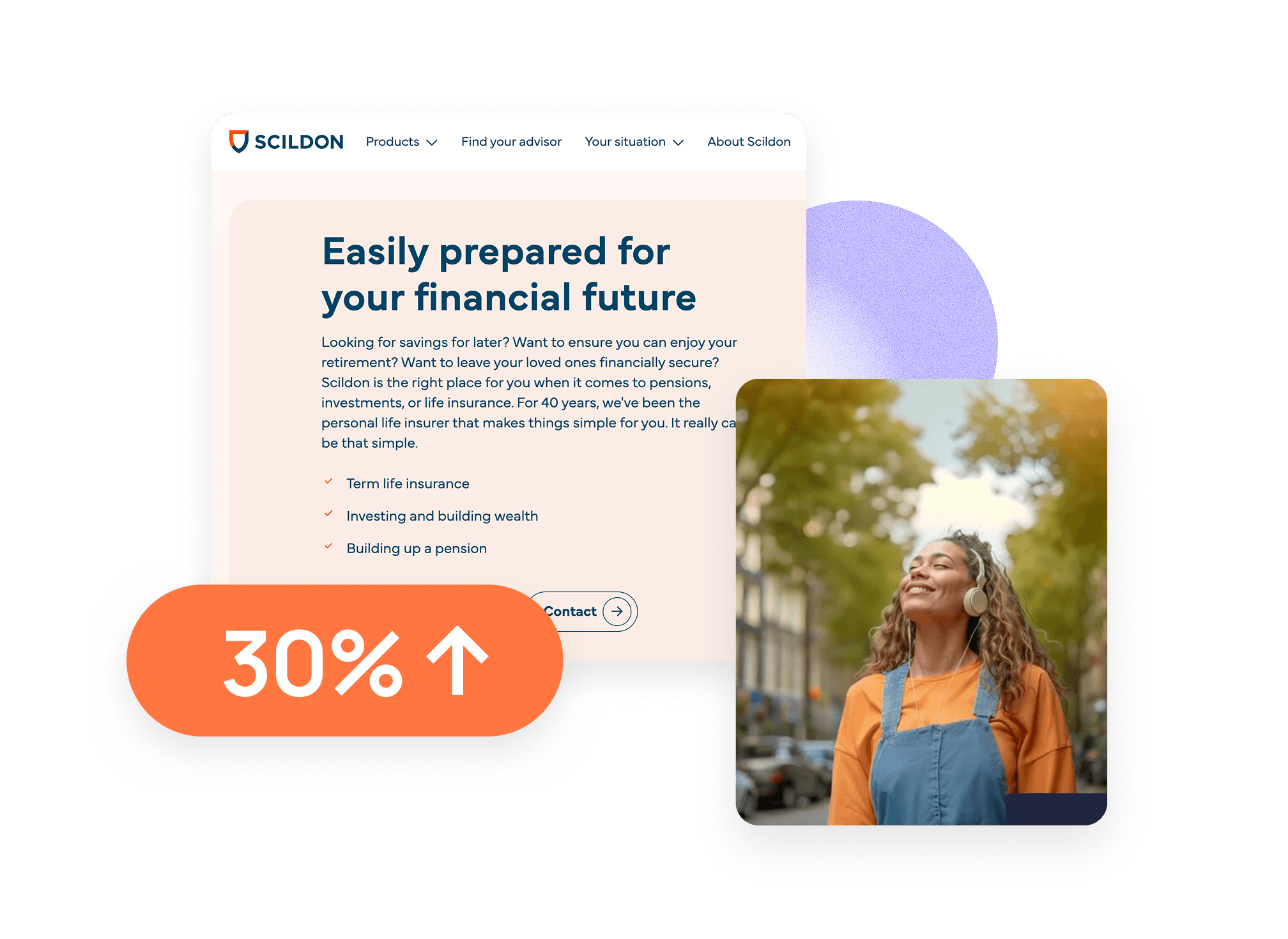

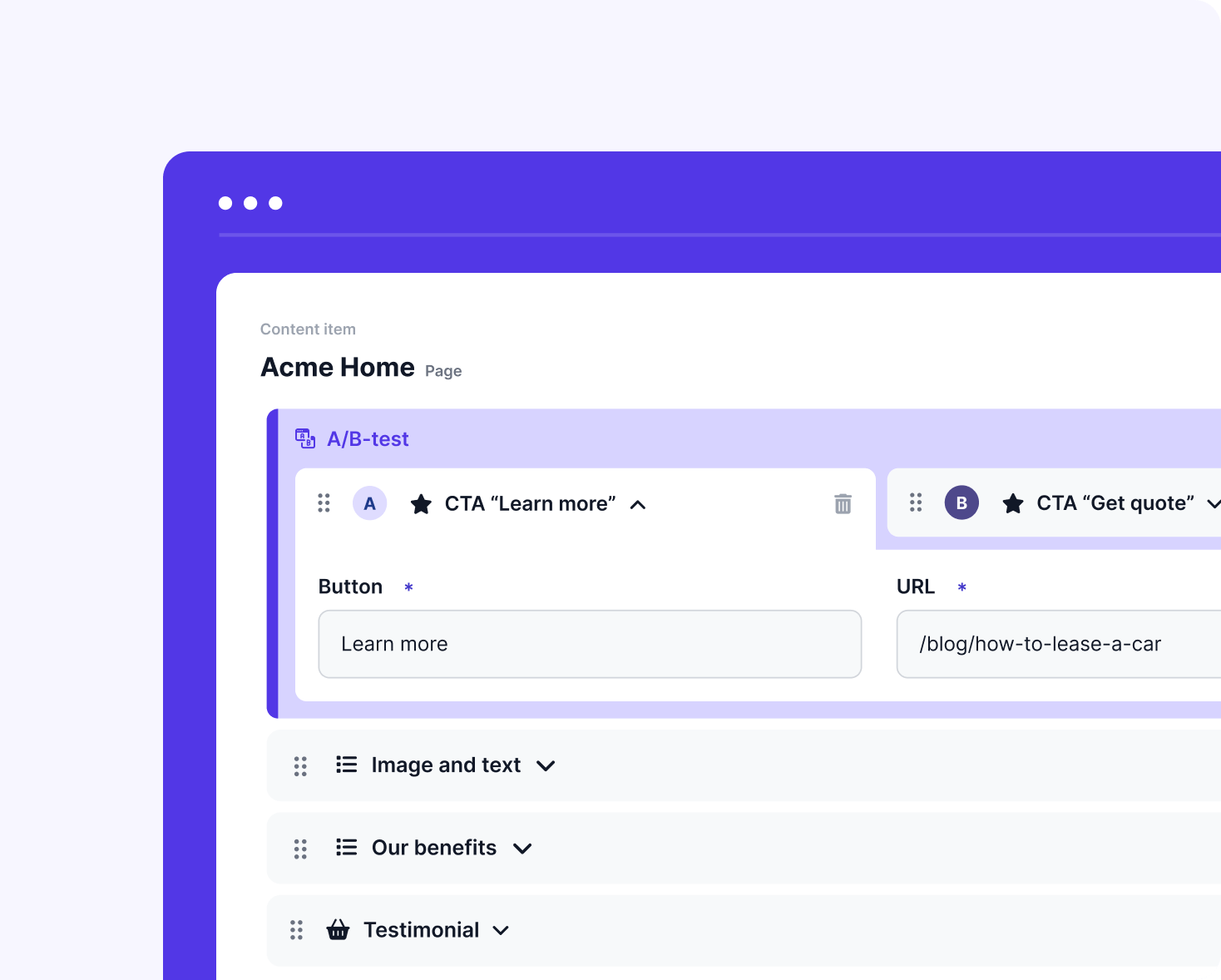

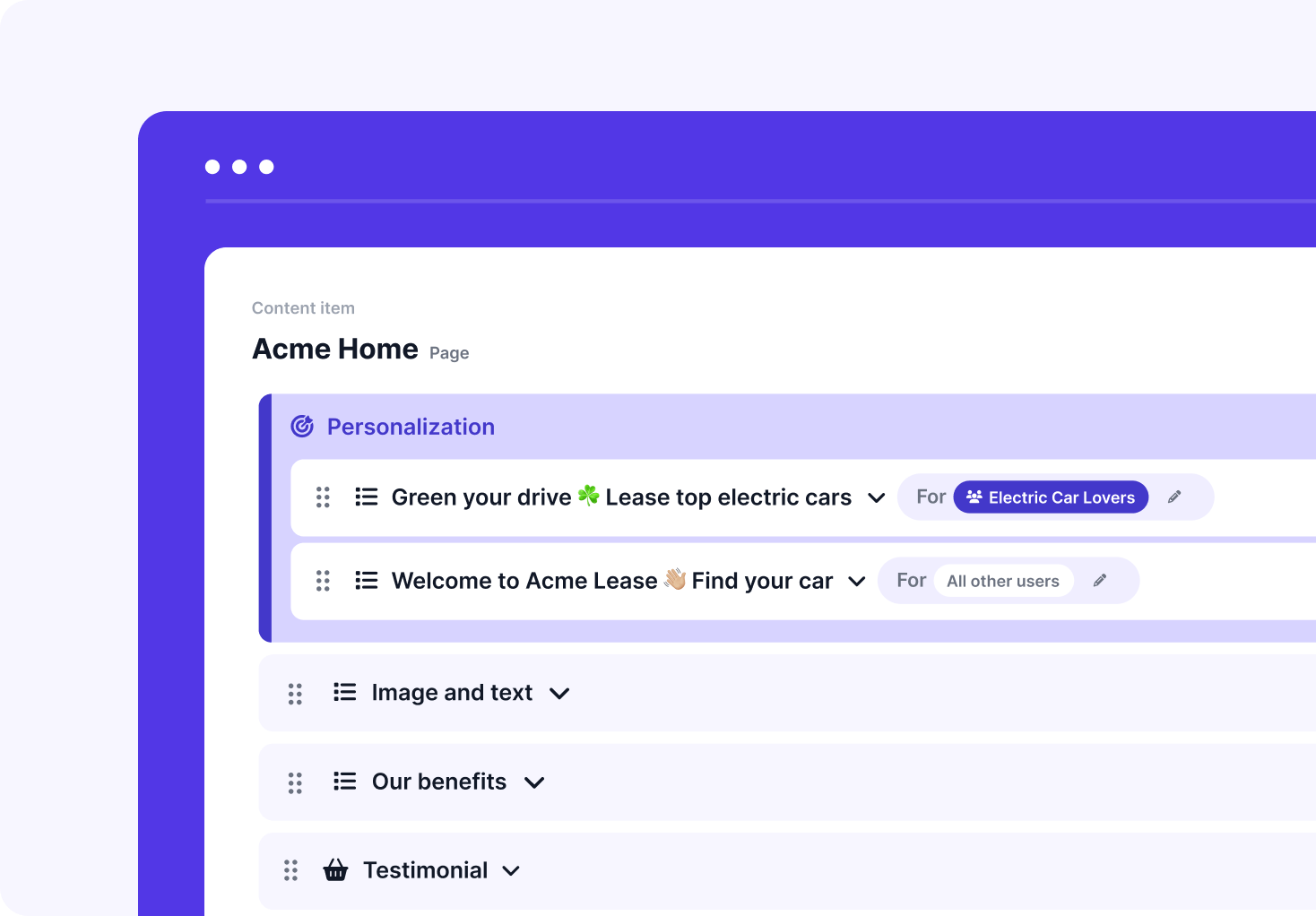

PERSONALIZATION

Show visitors the financial products that fit them best

Most financial websites serve the same generic offers to everyone. With Prepr’s personalization engine, you can adapt product pages for each visitor based on profile or behavior — recommending the right loan, insurance plan, or savings product. That relevance drives higher engagement and more conversions.

Buying Signals

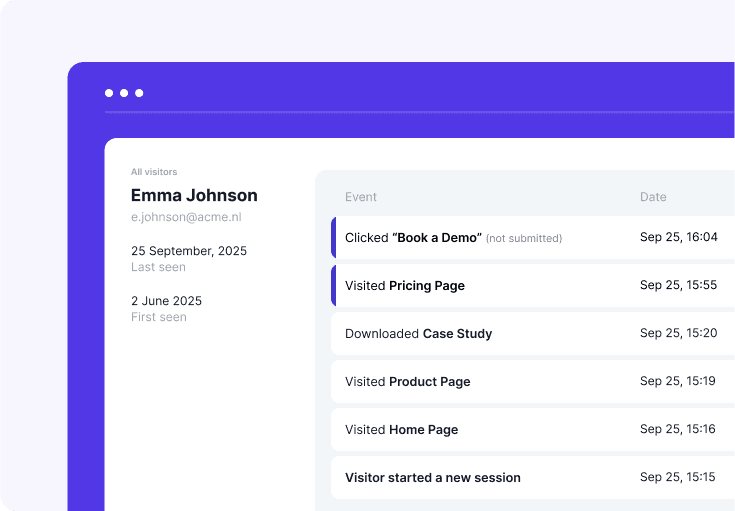

Give sales teams the signals that matter most

Advisors often lack visibility into digital intent. Prepr captures high-intent behaviors like pricing page views or repeat visits and pushes them straight into your CRM. That way, sales knows exactly which leads are ready for follow-up — and when to act.

Love the way Prepr enables us to build a new website very fast, with personalisation and A/B testing included. Implementing has been very easy and we were able to integrate with all the systems we need so far.

— Douwe J.T. | Board Member.

SECURITY & TRUST

Built for finance. Compliant by default.

Financial institutions face strict requirements for data protection and compliance. Prepr makes it easy to stay aligned with EU regulations, without sacrificing speed or flexibility.

Data sovereignty

Your content and customer data stay in the EU. Hosted in secure EU data centers with strict access controls.

Full DORA compliance

Prepr complies with the Digital Operational Resilience Act and offers an optional DORA Service Package with a supporting agreement to help customers meet all regulatory expectations.

GDPR by design

Personalization and data processing aligned with GDPR principles. No hidden tracking, full control over retention and consent.

Enterprise security

Encryption in transit and at rest, strict role-based access, and regular penetration testing.

Governance and control

Granular roles, approval workflows, and audit trails give your teams the flexibility to move fast within compliant guardrails.